FREE CTOS credit report! Manage your finances better

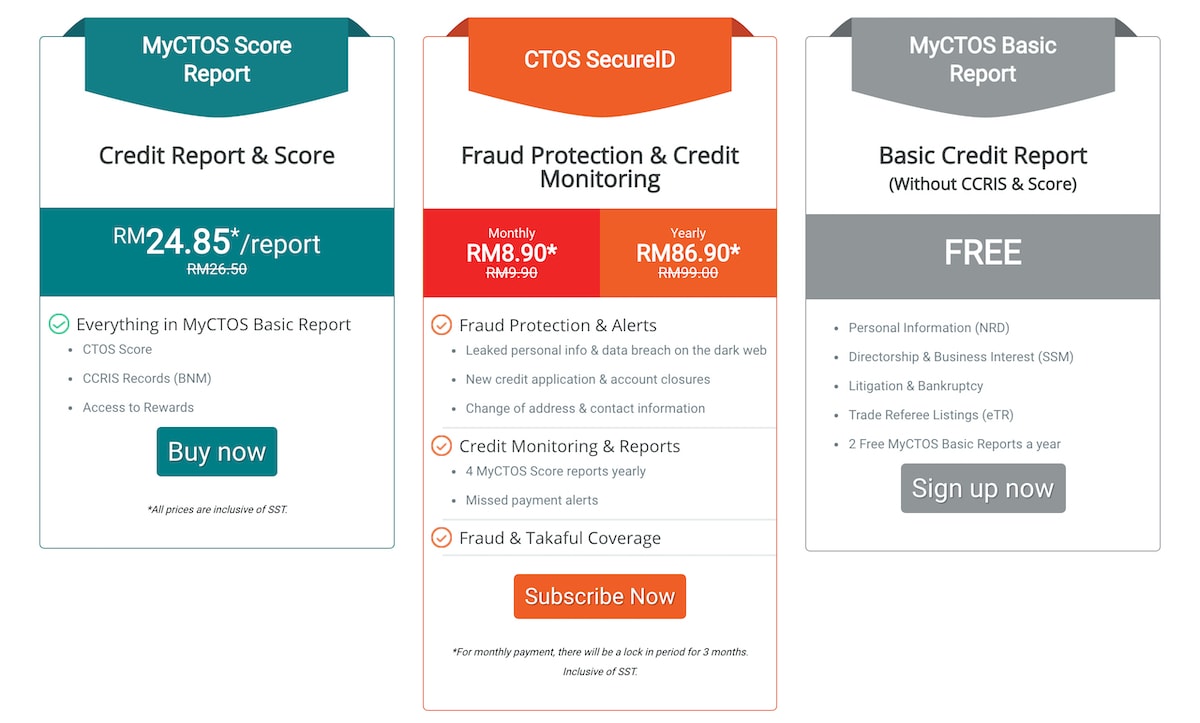

CTOS Data Systems Sdn Bhd is giving away FREE MyCTOS Basic to help you manage your finances better. You also can purchase for the complete credit report with credit score and CCRIS records.

Check your credit – FREE Ctos Basic Report

In line with the continuous effort to help everyone cope with the impact of COVID-19, the prices of ctos products have been reduced. The price reduction is valid until 31st Dec 2021. Ctos are also giving away a FREE MyCTOS Report with twice a year to help you manage your finances better.

What you get in FREE Ctos Report

- Personal Information (NRD)

- Directorship & Business Interest (SSM)

- Litigation & Bankruptcy

- Trade Referee Listings (eTR)

- 2 Free MyCTOS Basic Reports a year

MyCTOS Score Report

MyCTOS Score Report cost you RM24.85 per report during promotion period! It comes with CTOS Score to help you take control of your credit and increase your chances of getting a loan. CTOS Score is a 3-digit number that represents your creditworthiness. It is an evaluation of an individual credit history and capability to repay financial obligations. The higher the score, the higher your chances of securing a loan.

MyCTOS Score Report also included with the CCRIS Records from Bank Negara Malaysia.

Grab it now at ctos website!

About CTOS

Established in 1990, CTOS is Malaysia’s leading Credit Reporting Agency (CRA) under the ambit of the Credit Reporting Agencies Act 2010.

At CTOS, we facilitate credit extensions by empowering individuals and businesses with access to crucial information at greater ease and speed.

According to World Bank’s Doing Business Report 2014, Malaysia is deemed the easiest country to get credit in the world (out of 189 countries). We are proud to have contributed to that.

By providing information to credit grantors and creating transparency, we inspire greater confidence in them to transact with parties they would otherwise know little or nothing about. Hence, our mantra, “Knowledge creates confidence”.

However, we do not evaluate or make recommendations on credit applications. Lending involves many factors. Ultimately, an applicant must meet a credit providers’ risk appetites, business policies and strategies.

Credit is not a right. Needless to say, we must be prudent and responsible in our financial dealings which will have an impact in our search for credit. Given this, individuals and companies are urged to check their CTOS credit report regularly. This is to ensure accuracy and updates for quick and efficient processing of their applications.

CRAs are poised to further develop under the CRA Act 2010 to benefit the people, businesses and ultimately, the nation.